Property Auction Insights

December 2025

Property auction activity continues to evolve, shaped by regulation, behaviour, and changing expectations across the market. From shifts in residential supply to the way auctions are run and experienced, the data highlights both structural change and lighter moments that reflect the character of the sector.

This edition of Property Auction Insights brings together three perspectives. It looks at how vacant and tenanted stock has changed over time, explores a lighter look at festive property names and pricing, and outlines how new technology is being developed to support auctioneers and bidders alike. Together, they offer a snapshot of where the auction market is now and where it is heading.

Focus On: Landlord Behaviour Ahead of the Renters' Rights Act

Auction volumes have risen steadily since 2020, but the composition of that supply has changed. Residential stock is increasingly sold vacant, while tenanted volumes have failed to grow in line with the wider market. This shift coincides with the announcement and progression of the Renters' Rights Act, due to take effect in 2026.

For landlords, the Act introduces material change. The removal of Section 21, longer possession timelines, tighter grounds for eviction, and increased compliance obligations all increase holding risk. As a result, many landlords are reassessing exposure to residential lettings and choosing to exit before the new regime begins.

Auction Activity Across Property Types

The data shows a clear divergence between residential and non-residential assets.

Lots Sold

Average Sale Price

Lots Sold

Average Sale Price

Lots Sold

Average Sale Price

Residential vacant lots sold increased from 2,835 in Q1 2020 to 5,289 in Q3 2025. Over the same period, tenanted residential sales rose modestly from 550 to 851 and remained broadly static across multiple years. Growth in overall residential auction supply has therefore been driven almost entirely by vacant disposals.

Commercial and Mixed Use assets show a different pattern. Both vacant and tenanted volumes move broadly in line with overall market growth. Tenanted commercial lots sold increased from 241 in Q1 2020 to 293 in Q3 2025. Mixed use tenanted sales more than doubled over the same period, rising from 145 to over 300.

This divergence highlights that the change in behaviour is sector specific. Residential landlords are responding directly to regulatory change and increased uncertainty around possession, compliance, and long term risk. The decision to sell is often driven by timing rather than pricing.

Commercial and Mixed Use investors are not subject to the same legislative pressure. Lease structures remain contractual, possession rights are clearer, and income visibility is stronger. As a result, disposal decisions in these sectors continue to follow pricing, yield, and asset level strategy rather than regulatory avoidance.

Residential Vacant and Tenanted Trends

The residential pie data shows how landlord behaviour has evolved as reform moved from proposal to policy.

Posession Percentage

2024 - 2025

In 2020 to 2021, tenanted residential stock accounted for 23% of auction sales. By 2022 to 2023, this fell to 18%. In 2023 to 2024, the share briefly rose to 20%. This timing aligns with the formal announcement of the Renters Reform Bill in May 2023, when uncertainty around implementation was highest. During this phase, more landlords opted to sell with tenants in situ rather than delay disposal.

That position reverses sharply in 2024 to 2025. Tenanted residential stock drops to 15%, the lowest point in the series. By this stage, landlords had clearer visibility on timing and transitional arrangements. Many appear to have concluded that securing vacant possession before the Act begins is preferable to managing exit under the new rules.

Selling vacant carries cost. Rental income is lost during notice, marketing, and completion. There is also execution risk, particularly where formal eviction or extended possession processes are required. Despite this, the data shows landlords are increasingly willing to absorb those costs now to avoid higher legal and operational risk later.

Opportunities for Landlords Remaining in the Market

Yield data reinforces why some landlords are changing their tactics rather than leaving property altogether. Residential tenanted yields have improved since 2022, rising into double digits in several quarters. However, this uplift reflects higher risk pricing rather than improved fundamentals under future regulation.

Yields

Commercial and Mixed Use yields remain consistently stronger. Commercial yields exceeded 13% in multiple quarters from 2023 onwards, peaking above 15%. Mixed Use yields also remain robust, generally above residential and without the same legislative exposure.

For investors seeking income, these sectors offer clearer visibility on possession, lease structure, and cash flow. The stability in tenanted volumes supports this position. The data suggests landlords exiting residential are often reallocating rather than withdrawing.

The rise in vacant residential stock at auction is not incidental. It reflects a measured response to structural reform. Early uncertainty prompted a short-term increase in tenanted disposals. Legislative clarity has since driven a stronger shift toward vacant exit.

Residential auction supply is increasingly influenced by landlords adjusting position ahead of the Renters' Rights Act. The growth in vacant stock, the short-term rise and subsequent fall in tenanted disposals, and the divergence from commercial and Mixed Use trends all point to behavioural change rather than market distress.

Commercial and Mixed Use assets continue to attract capital where income visibility, lease control, and regulatory certainty remain clearer. For investors, the current auction landscape reflects timing and risk management decisions, not a loss of confidence in property as an asset class.

Focus On: When Festive Names Meet the Gavel

Festive names have a habit of popping up in auction catalogues well outside the Christmas period. Snow, Star, Holly, Elf, and even Santa appear attached to properties across the country, often when you least expect them. They catch the eye, raise a smile, and add a bit of seasonal character to what might otherwise be a fairly standard catalogue page. It naturally raises the question of whether a festive name brings a little extra luck when bidding starts, or whether it is simply a bit of decorative flair.

The data suggests the festive cheer stops at the name. Sale prices range widely, from modest auction lots through to higher value homes, with no clear pattern linking seasonal branding to stronger results. As ever, buyers focus on fundamentals. Location, condition, and demand do the real work. Festive names might add charm, but even at auction, buyers are not paying a premium for tinsel alone.

Focus On: Developments at EIG

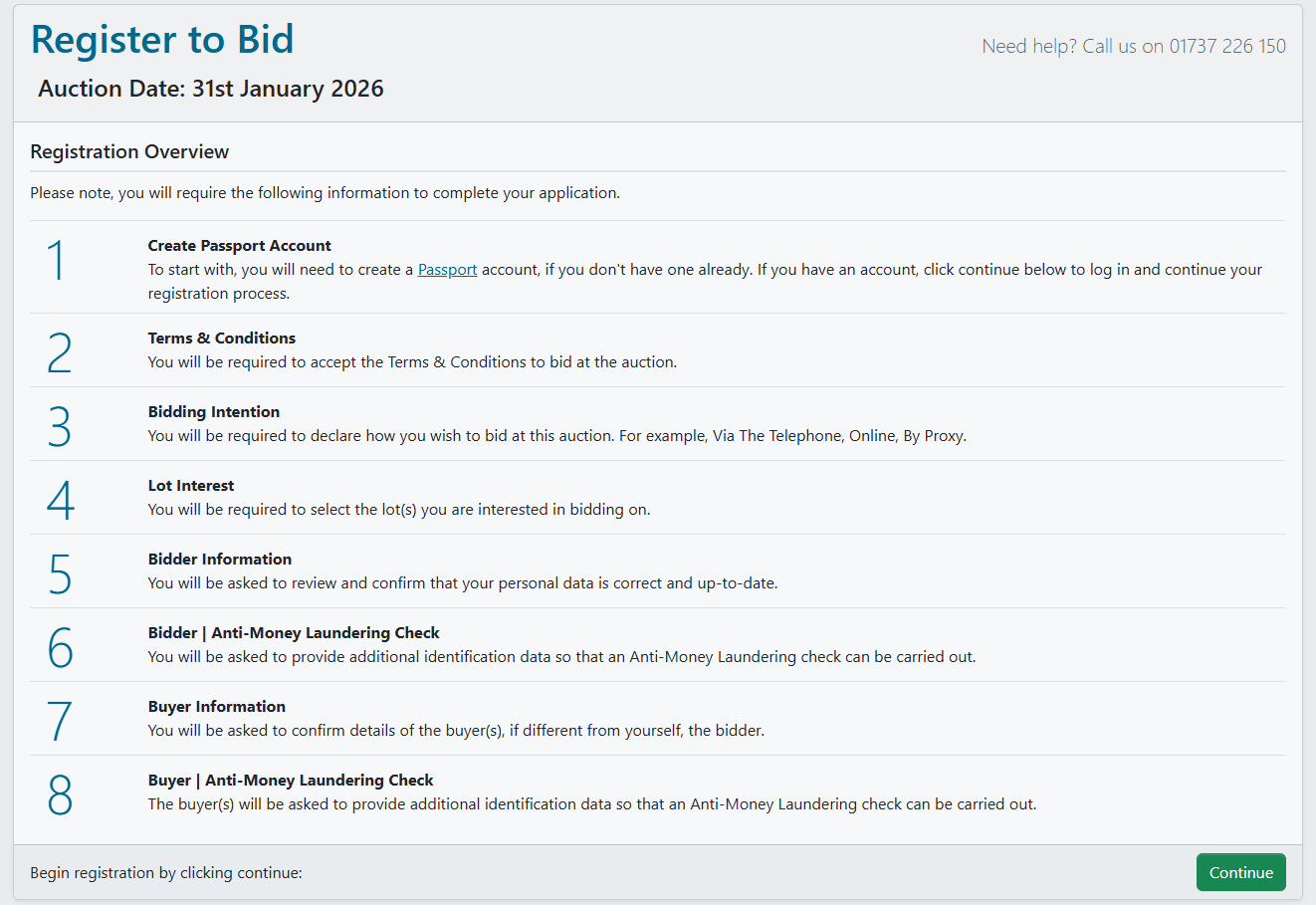

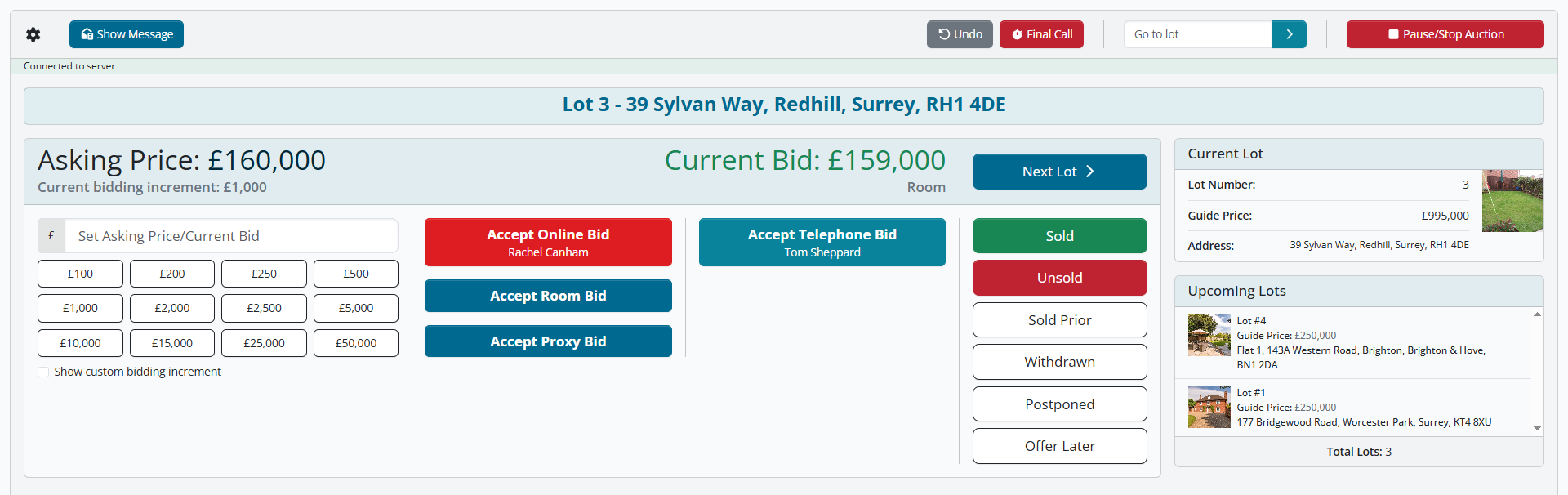

We have been spending a lot of time behind the scenes at Essential Information Group, and one of the biggest areas of focus has been our new Livestream System. This has been in development for some time and brings together the experience of our internal team with direct feedback from auctioneers and bidders. The aim was clear. Make livestream auctions easier to run, easier to join, and easier to manage, without adding extra steps or systems.

For bidders, the biggest change is the registration journey. The new system offers a clearer, faster registration process that is fully integrated with Auction Passport. Users can register, complete checks, and move straight into reviewing legal packs and bidding, all within one connected environment. The experience is cleaner and more intuitive, especially for those bidding regularly across multiple auctions.

For auctioneers, the platform brings everything into one place. Settings can be tailored at auction level, including AML requirements, contract details, and bidder checks. The SaleVision bidding platform itself has been fully upgraded and sits alongside registration and compliance tools, reducing duplication and manual administration.

Tom Sheppard said, "We're incredibly excited to launch our new live stream bidder registration service for the property auction industry. The enhanced platform introduces a comprehensive suite of features that enable auctioneers to complete all required bidder due diligence, including KYC and AML checks, while maintaining an intuitive, user friendly experience for auctioneers and bidders alike."

Rachel Canham added, "We have utilised our years of experience in the auction arena, alongside feedback from auctioneers across the country, to launch what can be seen as the new gold standard in auction management. With more auctioneers beginning their rollout for the platform, we have already set our sights on further improvements to bring more opportunities to truly improve the processes auctioneers go through in every auction cycle."

If you are currently using our SaleVision system, or would like to explore the new livestream platform for future auctions, please email admin@eigroup.co.uk to arrange a demo or speak with the team.

Regional Data

Every quarter we will be including regional data from the past five years, including the number of lots sold and the average sale price, and now average yield too. This allows you to track what is happening across the country, to spot trends, and see how changes in the wider market may be affecting auctions.

The data in these charts consist of all auction sales on a quarterly basis, including individual single lot sales.

Data for all unconditional auction sales.

Data for all unconditional auction sales where there is an income.

London

South East Home Counties

South West

Yorkshire & The Humber

North West

North East

West Midlands

East Midlands

East Anglia

Scotland

Wales

North West Home Counties

Northern Ireland

Regional Data Analysis

As with any part of the property market, auction activity doesn't happen in a vacuum. Broader economic factors can all impact both volume and pricing at auction. What we often see is that these changes show up in auction data before they're reflected in the wider market, making it a useful early indicator for spotting emerging trends. Tracking this data over time gives a valuable view of how different parts of the country respond to market pressures, and where opportunities may be emerging.

Closing Summary

This edition of Property Auction Insights highlights a market responding pragmatically to change. Shifts in Residential supply reflect landlords adjusting strategy ahead of the Renters' Rights Act, while Commercial and Mixed Use assets continue to provide stability for those seeking income with clearer regulatory footing. Alongside this, lighter data points remind us that auction catalogues still carry character, even as fundamentals continue to drive value.

At the same time, the way auctions are delivered is evolving. Investment decisions are increasingly supported by more integrated systems, clearer processes, and improved bidder experiences. Whether navigating regulatory driven changes in stock, identifying opportunity across sectors, or engaging with auctions through more advanced platforms, the common theme is adaptation. The auction market is not standing still. It is refining how it operates and how participants engage, creating a landscape that remains active, transparent, and opportunity led as the sector moves forward.

If there are any topics you would like us to focus on in future releases, or you have any feedback or thoughts you would like to share, please contact us on insights@eigroup.co.uk.

PS. Our next edition will be released in March 2026, so if you are not already on our newsletter mailing list, sign up today!

Disclaimer: The figures in this newsletter are based on sales data provided to us by the auctioneers.